Table of Content

Written By

GHR Global

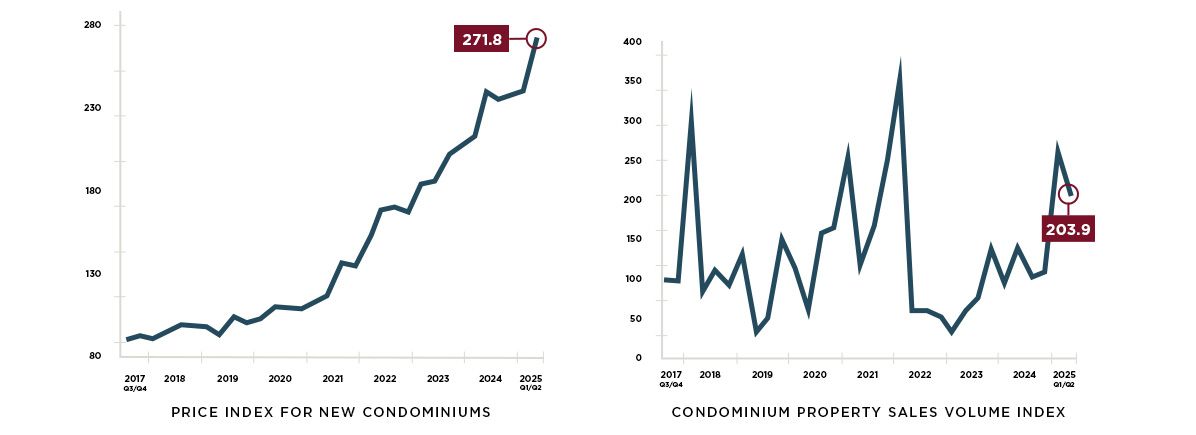

Digital Marketing TeamSri Lanka’s condominium market held firm through Q2 2025. In Colombo, the Price Index for New Condominiums reached 271.8, up 12.8% year on year, while the Condominium Property Sales Volume Index rose 44.2% year on year, pointing to stronger transaction activity across Colombo and other major cities.

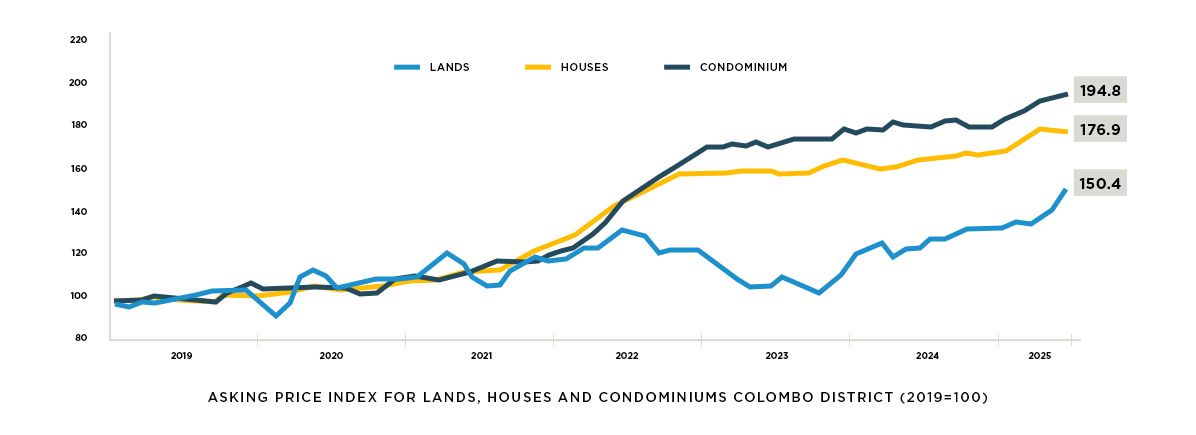

Asking prices also moved higher across residential asset types in the Colombo District. Year on year, lands increased 22.3%, houses 7.8%, and condominiums 8.4%. Within the quarter, index levels progressed from April to June as follows: lands 136.4 to 150.4, houses 178.3 to 176.9, and condominiums 191.4 to 194.8.

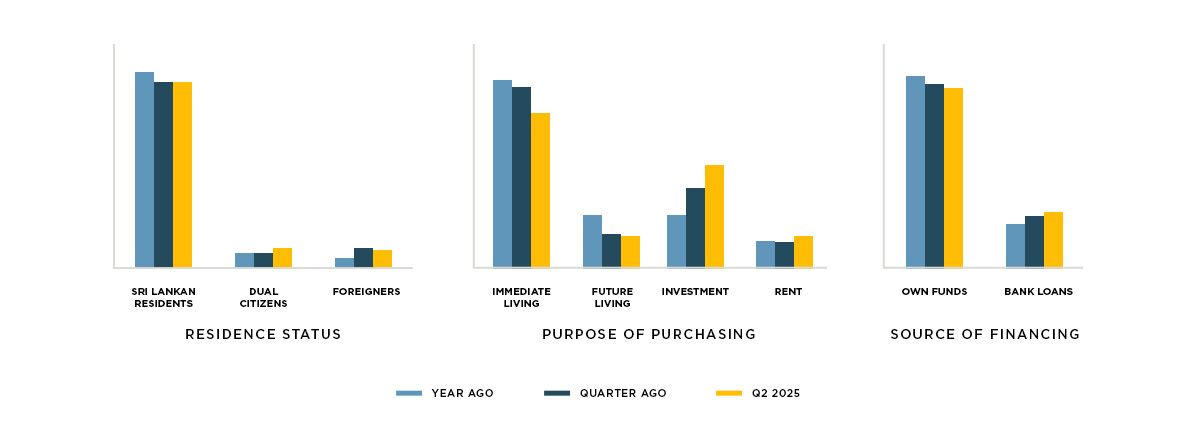

Demand remained weighted to the Western Province and nearby corridors. The highest share of condominium sales was recorded in Colombo, followed by Gampaha and Kalutara. Most transactions fell in the Rs 25 mn to Rs 50 mn bracket, with a visible pickup above Rs 75 mn. Absorption stayed healthy, with most units in completed projects already sold and 54% of units in ongoing projects reserved.

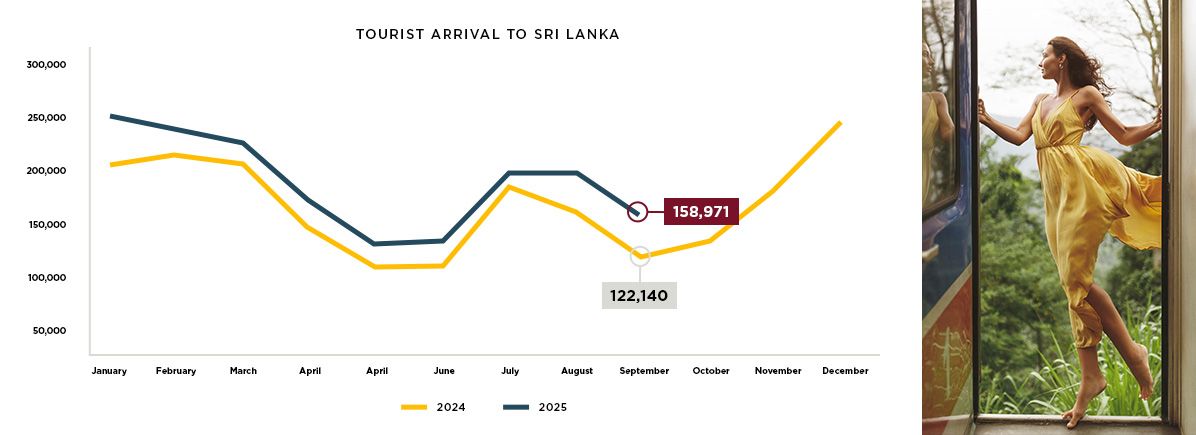

Tourism continues to reinforce demand for lifestyle-led assets outside Colombo. July 2025 recorded 200,244 arrivals versus 187,810 in July 2024 (+6.6% YoY). August 2025 reached 198,235 versus 164,609 in August 2024 (+20.4% YoY). September 2025 finished at 158,971 versus 122,140 in September 2024 (+30.2% YoY). Year to date to September, arrivals total 1,725,494 versus 1,484,808 for Jan to Sep 2024, an increase of about 16.2%.

The financing and macro backdrop remains supportive. The Central Bank maintained the Overnight Policy Rate at 7.75% at its September 2025 review, following a 25 bps cut to 7.75% in May 2025, which helps buyers plan with greater confidence. The wider economy expanded 4.9% year on year in Q2 2025, with Industry +5.8% and Construction +8.5%, a constructive setting for residential development and related services.

What this means for GHR investors

- Condominium price and activity trends in Colombo validate market confidence and scarcity. For Edmonton Bliss in Colombo 05, the combination of firm asking prices and healthy absorption supports an early-entry, limited-inventory narrative.

- For hotel residencies in Negombo, Hikkaduwa, and Nuwara Eliya, the tourism upswing in July, August, and September strengthens the case for occupancy and rate resilience through the high season.

- Stable policy rates and improving growth conditions provide a supportive environment for purchase decisions and project progress across the portfolio.

Sources: “Real Estate Market Analysis – Condominium Market Survey: Q2 2025” and “Real Estate Asking Price Trends: Q2 2025”; SLTDA Monthly Tourist Arrivals Reports 2024–2025 and Weekly Tourist Arrivals Report for September 2025; CBSL Monetary Policy Review No. 03 of May 2025 and No. 05 of September 2025; Department of Census and Statistics National Accounts Q2 2025.