Table of Content

Written By

GHR Global

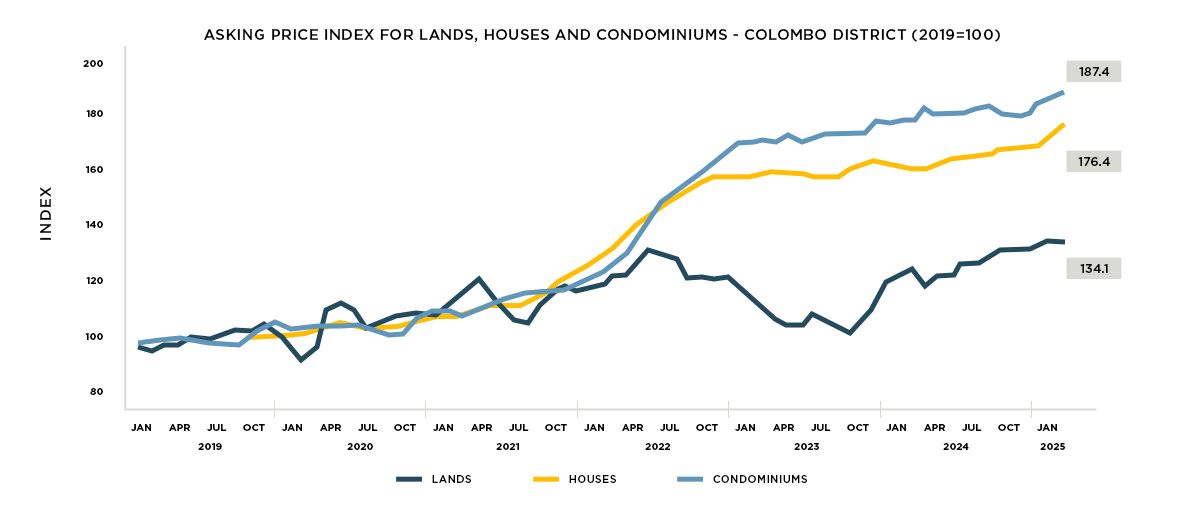

Digital Marketing TeamSri Lanka’s property market continues its recovery streak into 2025. According to the latest data from the Central Bank, land, house, and condominium prices in the Colombo District have posted notable year-on-year increases. Lands saw a 7.3% price rise, houses gained 10.4%, and condominiums increased by 5.5% compared to Q1 2024.

Although the pace of land price growth has eased from its 2024 peak of 29%, the ongoing upward trend confirms investor confidence and market stability. As domestic macroeconomic indicators stabilize and tourism gains momentum, the real estate market appears well-positioned for sustained growth.

Condominium Market Sees Sales Surge

The condominium sector, in particular, posted strong performance in Q1 2025. The Condominium Property Sales Volume Index increased by a staggering 133.3% quarter-on-quarter, indicating a significant spike in transaction activity.

What’s especially notable is the shift in regional demand. While Colombo remains central to the market, Gampaha and Kalutara Districts collectively accounted for the largest proportion of sales. This dispersion reflects increasing interest in tourism corridors and suburban growth zones. These factors are redefining where and how Sri Lankans invest.

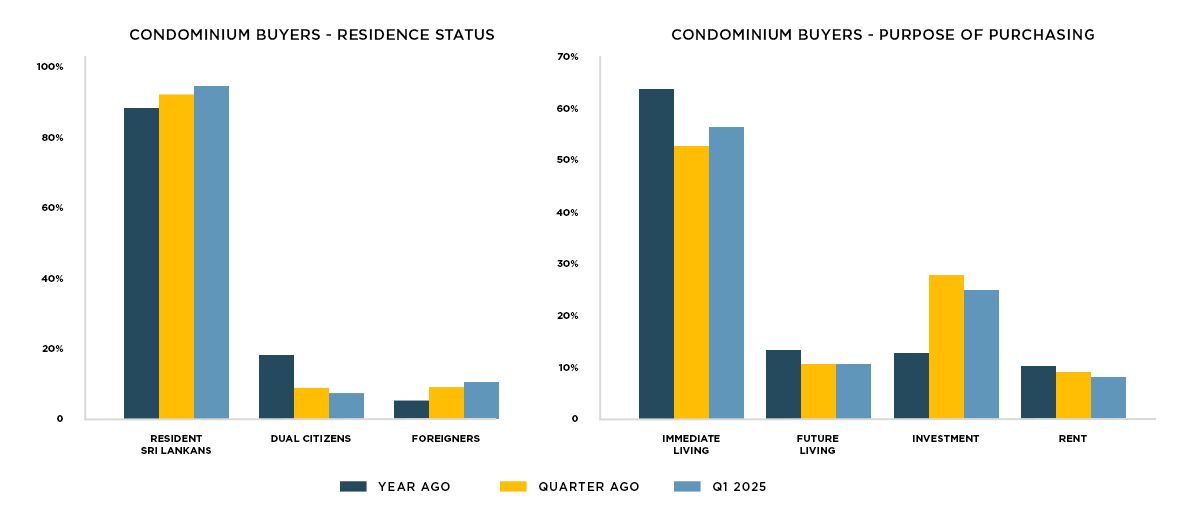

Buyer and Developer Profiles Reveal Strong Local Confidence

Despite increasing interest from international investors, most buyers of condominiums remain Sri Lankan residents. A large majority are funding their purchases through personal savings, not loans. The most popular price category is Rs. 25 million to Rs. 50 million, reflecting both premium urban demand and middle-upper tier investment appetite.

As for developers, funding models remain largely dependent on pre-sale deposits, equity, and bank loans. The report shows that over 46% of units in ongoing projects are already reserved, while completed projects have sold most of their inventory.

What This Means for Investors

With prices and transaction volumes both trending upward, early movers in Sri Lanka’s property market stand to gain from both capital appreciation and strong rental yields. The diversified regional growth, extending beyond just Colombo, signals growing opportunity in destinations that cater to both tourism and residential demand.

Areas like Negombo, Sigiriya, Hikaduwa, and Nuwara Eliya are drawing investor interest thanks to their dual appeal: leisure tourism and structured hotel-residency projects. In Sigiriya, for example, a new wave of sustainable developments is aligning with the area's recognition as Sri Lanka’s first certified Sustainable Destination. Similarly, ongoing projects in Negombo have seen over 50% pre-launch sales fueled by both local and overseas investor demand.

At GHR, several of our current projects across Colombo and emerging hotspots reflect these broader market dynamics. With flexible payment plans and professionally managed investment models, our portfolio continues to attract clients seeking reliable returns and long-term value.

Sources: Real Estate Market Analysis - Condominium Market Survey: 1st Quarter of 2025