Written By

GHR Global

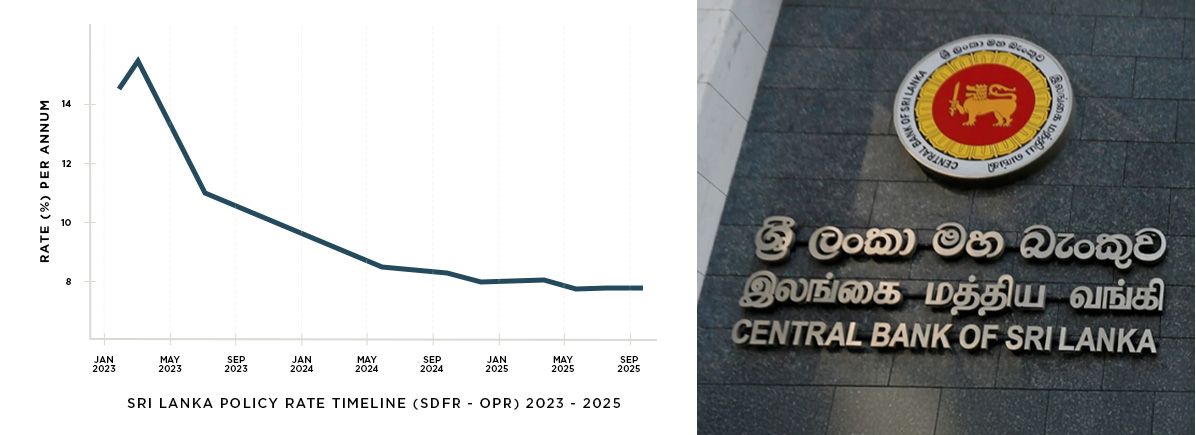

Digital Marketing TeamSri Lanka’s policy rate has shifted to a single Overnight Policy Rate (OPR) and eased to 7.75% as of May 22, 2025, after the move to a single-rate framework on November 27, 2024. With 12-month fixed deposits now around 6.5–7.0% at major banks, passive cash no longer compounds meaningfully.

Notes: Chart shows SDFR until Nov 27, 2024 and OPR thereafter; shaded band reflects typical 12-month FD boards in 2025 (~6.5–7.0%). Sources: CBSL policy releases; state-bank rate boards.

What the flow data says right now

Retail participation in equities has surged as savers hunt yield: 6,387 new CDS accounts were opened in October 2025, lifting Jan–Oct new accounts to 44,047 versus 14,062 in 2024. That’s momentum, but it also raises timing risk for newcomers.

Meanwhile, foreign portfolio flows can flip quickly. In the week ending November 13, 2025, offshore investors were net sellers of about US$3.07 million in rupee government securities, with total foreign holdings at Rs 140.4 billion (~US$468m) as the rupee saw mild pressure. This is a reminder that traded markets can whipsaw just as the rate cycle is rewarding patience.

Tourism, by contrast, continues to deepen demand for stay-led assets: October 2025 arrivals reached 165,193, up 21.5% year-on-year—a helpful tailwind for occupancy and rates in the right locations.

Why act now with GHR

Quality inventory is finite and price steps up with each construction milestone. GHR’s hotel residencies convert tourism demand into monthly cash flow while the underlying real estate compounds value over time. Phase 1 of Ocean Breeze Negombo has already delivered 200%+ ROI, validating both rental strength and exit potential.

Flagship hotel residencies

- Ocean Breeze Negombo – Phase 2

A 25-floor, 287-unit beachfront hotel residency designed to capture Negombo’s year-round visitor flow and translate it into predictable rental income. - Ocean Breeze Hikkaduwa

Beachfront studios to 3-bedroom residences and duplexes with full amenities on a highly liquid leisure coastline, holiday demand does the heavy lifting on occupancy. - The Kingdom Sigiriya

Studio and 2-bedroom hotel residencies near the UNESCO-listed rock fortress, paired with wellness-led amenities, high visibility and resilient year-round draw. - Lakefront Residencies, Nuwara Eliya

Gregory Lake frontage in the hills with managed hospitality, scenic magnetism, plus professional operations equals durable yields.

GHR Global

Make your move now

Deposits pay less, equities demand perfect timing, and short-term flows are fickle. Income-producing property offers immediate yield and long-run compounding with tangible downside protection. GHR’s hotel residencies and select city assets are positioned to capture this cycle’s winners; allocations made today can lock in superior total returns for years.